In the wake of ongoing Facebook changes, we launched The Keywee Facebook CPC Tracker last January to provide publishers with monthly updates on Facebook CPCs and industry trends, based on analysis of data from over 500 publishers.

Each month, we release new data, along with relevant insights on content distribution. You can sign up for monthly updates straight to your inbox here, and read past months’ updates here.

January Recap

In January, we saw publishers double down on subscription and membership strategies. Conde Nast announced that all of its titles would be behind a paywall by the end of the year and Barstool Sports’ “Barstool Gold” membership product had more than 10,000 sign-ups within 48 hours of its January 8th launch. Meanwhile, other publishers (like The Economist and the Washington Post) are turning to branded podcasts as an additional revenue source in this age of revenue diversification.

One thing is clear: 2019 will be the year where publishers strive for profitable growth. After sweeping layoffs across the organization, Buzzfeed is restructuring and rebuilding with profit at the center of the business model, rather than revenue. Bloomberg Media saw success with this approach in 2018: “Profitable growth is the north star for any business” said CEO Justin Smith, explaining their revenue diversification strategy that drove double digit growth for the company last year.

We also saw platforms usher in the new year with expansion efforts. Facebook announced a $300 million commitment to support local news publishers, including an expansion of their local news Accelerator program. Reddit, on the other hand, expanded its current advertising offerings by introducing CPC ads.

January Data

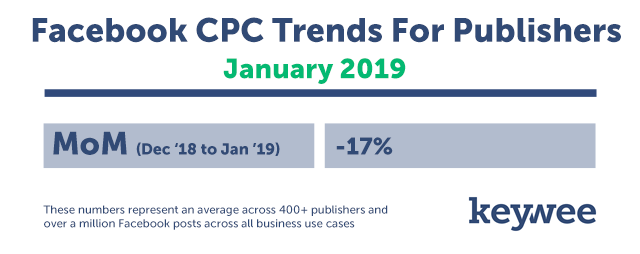

The year began with a 17% drop in Facebook CPCs from December 2018 to January 2019. If you’ve been following our CPC Tracker, you’ll know that a CPC decrease at the beginning of the year is to be expected, as CPCs are typically at their highest in Q4. However, publishers were glad to see this double-digit decrease in prices to kick off 2019 after an expensive year on the platform. This 17% decrease is about on par with what we saw last January(19%).

Because of these predictable CPC decreases, January is typically a great time to test and scale new content or campaigns with less risk. In any given month the first few days tend to have lower prices than the rest of the month (on average). These two effects together makes the first few days of the year the most opportune time to distribute content on Facebook. Teams that organized a content distribution plan before their New Year’s break saw their campaigns benefit from the advantageous pricing. (Want to do this in the future? Think about leveraging your evergreen content).

Why we’re no longer reporting on YoY trends

For the past twelve months, we’ve released a monthly update on Facebook CPCs (see all past posts here). This project began in an effort to understand the effect Facebook algorithm changes were having on content distribution prices, but developed into a status update for the industry as a whole. Each month, we not only provided information on Facebook pricing, but also a look at where publishers were focusing their efforts, what new changes platforms had rolled out, and what to expect from the months ahead.

However, as we looked back on 2018, we realized that publishers’ use of the platform had changed drastically since the beginning of the year. While prices on the platform have definitely been steadily increasing since late 2017, there are many other factors that were also contributing to the large year-over-year increases in pricing.

For example, last January, more than 50% of publishers’ spend on the platform was spent driving traffic for audience building or ad revenue purposes — the types of campaigns that rely on driving the biggest audience at the lowest price. This year, we saw just 37% of spend going toward the same types of campaigns. Publishers instead focused on driving groups of specific qualified users to content and optimizing for off-Facebook actions like email subscriptions, paid subscriptions, and affiliate link clicks. This naturally drives up the price of a click on Facebook, despite having better ROI in the long-run.

This trend to optimize around high-value users is just one of the many ways that publishers have updated their strategies when it comes to content distribution. To read more about the trends that will shape 2019, download our Content Distribution Trend Report.

Because of the ever-changing nature of the platform and publishers’ businesses, we’ll now focus on the short term changes affecting publishers day to day, as well as understanding the impact those changes are having on the future of the industry.

To sign up for future CPC updates, fill out the form below:

About Keywee

At Keywee, we make stories relevant and powerful for the world’s best storytellers — like The New York Times, The BBC, National Geographic, Forbes, and Red Bull.

Today, people aren’t coming to websites to search for content — stories find their audiences in feeds and apps. The upshot? Distribution is now the key for effective storytelling. Keywee’s platform unlocks audience insights using AI and data science, and infuses them into every step of the storytelling process: from topic selection, to story creation, to distribution and optimization. Keywee is backed by leading investors such as Google’s Eric Schmidt and The New York Times, and has been a fast-growing, profitable startup since its inception. To learn more, request a demo here.